Introduction

Companies allowed to trade on regulated markets in the UK are mandated to produce their annual financial reports (AFRs) using a structured digital format known as Inline XBRL (iXBRL). This report is submitted to the Financial Conduct Authority (FCA) for filing in the National Storage Mechanism (NSM).

Building upon a previous early implementation study of voluntary practice conducted in 2021, the Financial Reporting Council (FRC) Lab has published a new report where it identifies key learnings from the first year of mandatory structured digital reporting under ESEF.

To gather feedback and identify areas of improvement by reviewing a sample of these filings by UK companies, the Lab held outreach events with companies and other stakeholders such as design agencies, XBRL tagging service, and software providers, as well as assurance providers.

In the following sections, we will take a brief look at the basis and focus of the study, who it is for, what the three key areas of the survey were, what companies can learn from the findings, and lots more.

High-quality Digital Reporting – The Need of the Hour

The HMRC was among the first regulatory and tax authorities in 2011 to require UK entities to report to them in a digital format. The UK’s Companies House is the official registrar of companies in the country and also allows voluntary digital reporting to it. While tax reporting in iXBRL has been around for over a decade, this study conducted by the FRC solely focuses on digital reporting under the Disclosure Guidance and Transparency Rules (DTR) requirements.

Under the DTR, companies in its scope must produce their AFRs in the electronic reporting format prescribed in the TD ESEF regulation, the UK’s version of the ESEF Regulatory Technical Standard (RTS). Adoption of ESEF became effective for AFRs published on or after 1 January 2021 and ushers UK corporate reporting into the digital era.

The introduction of structured digital reporting in a usable and comparable format helps companies be more transparent with their shareholders and promotes the effective functioning of the capital markets. However, this is possible only if the resulting reports are high-quality and usable in practice.

With that in mind, let’s take a closer look at the focus areas of the Lab’s study that hold the key to high-quality digital reports complying with the ESEF mandate.

FRC Lab’s ESEF Reporting Study – Key Areas

Building off of their early implementation study conducted last year, there are 3 focus areas of the FRC Lab’s review of structured digital reporting in the UK under ESEF. These are:

- Tagging

- Process

- Usability and Design

Analyzing a sample of the filings from the first year of mandatory structured reporting in the UK, the FRC used public data along with data made available by the FCA for this study. While it found measurable progress since its last implementation study, the results of this analysis leave much to be desired in the terms of data quality and usability of the reports, unbecoming of companies in a leading capital market.

Among its many observations in these 3 areas, it found various opportunities for companies to improve their processes when it came to structured digital reporting by outlining two kinds of workflows. The Lab’s study also investigated tagging in-depth and suggested ways for companies to mitigate errors. Finally, it identified issues with the design and formatting in the human-readable layer of the XHTML document and the loading time of these documents among other things. In the coming sections, we will touch upon these issues in more detail.

FRC Lab’s ESEF Reporting Study – Who this Study Benefits and How

Among the primary beneficiaries of this study are companies filing to the FCA who need to assess whether changes to the core taxonomy they use have any impact on their tagging, like transitioning from IFRS 2020 to IFRS 2021, for example. This report can also guide regulators, analysts, and investors in understanding ESEF reporting in the UK in greater detail and make value judgments accordingly. Regulators can lay down more specific guidance for filers and aid them in publishing ESEF reports that are more suited to the purpose of improving data transparency and comparability.

FRC Lab’s ESEF Reporting Study – An Overview

Since the requirement for iXBRL tagging only applies to companies using the EU IFRS accounting standard, not all of the 679 mandatory reports filed on the UK NSM at the end of July 2022 contain XBRL tags. A little over 65% of the companies had tagged AFRs that could be further studied for the purpose of this review.

The 443 companies that had iXBRL-tagged AFRs provided over 150,000 data points to inform the findings of this study. The FRC’s Lab focused primarily on three areas of improvement:

Tagging – The FRC Lab found that most of its guidance from last year’s implementation study remains applicable. This includes using the correct sign, avoiding concealed facts (an issue that appears to be largely resolved in filings this year), investigating warnings, and avoiding changes to standard labels of tags. It makes additional observations on anchoring, choice of taxonomy, calculations, and further voluntary tagging that we will explore further in the next section.

Process – The study identified opportunities for companies to make their processes more efficient in the long term despite companies preparing structured digital reports in line with prescribed requirements. Various contributory factors include the level of involvement, ownership, and governance by companies, the workflow adopted to produce these reports, the manner of submission to the NSM, external assurance, and filing in multiple jurisdictions.

Usability & Design – Investigating the visual quality of reports, the Lab’s report noted an improvement in formatting and readability across the board. It also made observations on the availability of iXBRL reports on corporate websites, submission timings, file size and loading times of reports, and embracing XHTML as a web-based format for reporting, changing the way they think about report layouts as opposed to the PDF’s traditional A4 size.

In our last and final section, let’s take a closer look at what the report unearthed across all three focus areas and what lies in the future for companies vis-a-vis digital structured reporting.

FRC Lab’s ESEF Reporting Study – The Findings

The FRC Lab’s study highlights certain aspects of a sample of UK companies’ digital corporate reports and focuses on innovation and best practices that should be followed to produce more useful information for all concerned stakeholders. Let’s look at what the Lab found across the three focus areas.

1. Tagging

The study continued to observe tagging errors in the reports submitted to the NSM, observing that it is crucial for companies to continue improving data quality if they want investors to be unreluctant in using structured reports in the future. It also noted that poor tagging quality can be construed as an indicator of weak underlying processes and this may influence their decisions in a big way.

Apart from the guidance, it provided as part of its implementation study last year, the Lab felt it important to reiterate and highlight five factors to guide filers in the right direction.

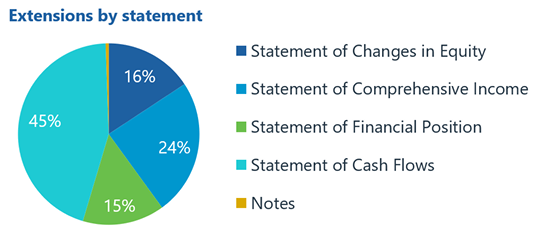

- Extensions and Correct Tags – In a sample of 50 reports submitted to the NSM till 31 July 2022, the study found 400 tags on average with 86% tags from the core taxonomy and the remaining 14% tags being extensions (custom tags). These rates vary by industry and statement type. The graphic below illustrates extension rates based on statement type.

Source: FRC Study

Source: FRC Study

- study noted that some companies created unnecessary extensions despite a core taxonomy concept with a similar accounting meaning being available, used the wrong core taxonomy tags across different statement types, and missed mandatory tags such as principal place of business even though the information was disclosed, and used core tax taxonomy tags instead of extensions.

- Anchoring – Even though there were core taxonomy tags that were closer in accounting meaning, the Lab found extensions for which the wider anchor chosen was a very generic tag, defeating the purpose of anchoring. Conversely, it also found extensions that simply did not have narrower anchors even if they were an aggregation of tags from the core taxonomy. The FRC advises companies to look at anchoring guidance and examples from XII’s dedicated working groups.

- Choice of Taxonomy – Companies preparing structured digital reports in the UK to have a choice between the UKSEF and ESEF taxonomies per the list of permitted core taxonomies maintained by the FCA under the TD ESEF regulation. While the ESEF is already widely used in Europe, the UKSEF provides a mechanism to use tags from the ESEF taxonomy along with other tags from the suite of FRC taxonomies. This includes tags for voluntary Streamlined Energy and Carbon Reporting (SECR), gender pay gap, TCFD reporting, and companies that want to submit their structured digital reports to the Companies House. With a proposed move by the department of Business, Energy and Industrial Strategy (BEIS) to move to mandatory reporting to Companies House, the UKSEF may see a larger influx of companies using it in the future.

- Calculations – Subsequent to having found incomplete calculations in some reports, the Lab advises companies to establish calculation relationships to the best of their ability in primary financial statements. Calculations help users understand the relationships between data points and allow companies to spot errors with the scaling and signs of numbers in their structured reports.

- Voluntary Tagging – The study notes that companies may wish to go beyond block tagging requirements and tag notes of interest to users in more detail. This could include notes providing a roll-forward or complete disaggregation of amounts in primary financial statements such as segment reporting. This would allow users to use calculation relationships to drill down to the detail in notes. Companies tagging alternative performance measures could also look at tagging the reconciliation to the closest IFRS measure.

2. Process

Improvements in filing processes form one of the most critical pillars of the Lab’s guidance resulting from its study. Raising process efficiencies can not only save precious time and resources for current and prospective filers but can also help them ameliorate the quality of their final submissions, making them more usable for all concerned stakeholders.

With that in mind, participants were asked to join a public call or were approached directly by the FRC to understand if there was scope for improvement in five core areas.

- Company Involvement, Governance, and Ownership – The Lab’s study consulted assurance and tagging providers who indicated that some companies were unwilling to take complete ownership of the quality of reports they were producing. Whether at the Board or senior management levels, personnel wasn’t sufficiently involved in the tagging and review processes. There was an overwhelming focus in many companies to prioritize the production of the annual report in PDF with structured reporting remaining an afterthought. As it is the official version for DTR purposes, the Lab noted that structured reports should be subjected to appropriate governance and review processes. Subsequently, it suggests companies provide disclosures explaining their approach to governance and document controls and processes to retain knowledge that can be used by newer members of staff.

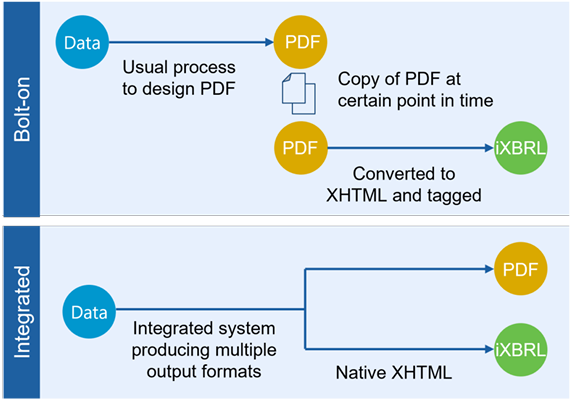

- Workflows – The study found two ways companies approach the preparation of a structured report. Using a bolt-on approach, companies focus on preparing their annual report in PDF as before, which is then converted into XHTML at a particular point in time and then tagged. The integrated approach utilizes a more sophisticated disclosure management solution in conjunction with design tools that enable tagging in parallel with the finalization of content inside an annual report along with its design. While most companies that were part of the outreach continued to use a bolt-on approach, there were some that found it viable to move to an integrated approach. This may become more ubiquitous over time as tagging requirements expand to notes and other sections of the annual report.

Source: FRC Study

Source: FRC Study

- Submissions to the NSM – The study noted that the FCA’s test filing facility, which allows reports to be validated without submitting them, was utilized extensively by several companies. A total of 700 test files were submitted by the end of July 2022 with FCA data showing that many filers needed more than one attempt to file their structured report successfully. A large chunk of errors was related to incorrect filing names and structures. The FCA provides guidance on this and other frequently observed errors.

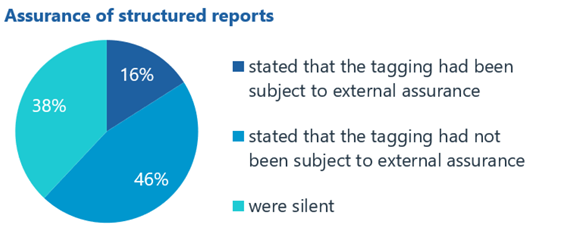

- Assurance – Although not mandatory at this point in time in the UK, companies may consider seeking external assurance over tagging, with the FRC adopting ISAE (UK) 3000 to support the delivery of these voluntary engagements. The graphic below shows assurance in a sample of 50 structured reports that were studied to understand where companies stand vis-a-vis discussions with assurance providers.

Source: FRC Study

Source: FRC Study

- It was noted that explicit statements about tagging assurance in structured reports were largely driven by which accounting firm was involved in their production. Prepares and tagging providers also voiced concerns about assurance being a challenging discussion, especially where judgment is involved. There was agreement, however, when it came to an improvement in the understanding of processes and requirements leading to better discussions and higher-quality reports.

- Filing in Different Jurisdictions – The Lab analyzed reports from 44 companies with listings in stock exchanges in both the UK and the EU and found 36% of them filing reports that did not match with each other. While some variations are inevitable owing to language differences and content requirements, the rest of the report should largely remain unchanged. EU versions of the reports were also usually subject to assurance or audit relating to ESEF, a section that was omitted from the version that was submitted in the UK. When it comes to companies with dual filings that include the US, things can get a bit more complicated. While core requirements are largely aligned (usage of the iXBRL format and the IFRS core taxonomy), several technical and content requirements may make it impossible to prepare a single filing that is acceptable to the US SEC. Most companies were found to have different processes for UK/EU and US versions of the filing, but the FRC advises companies to explore software tools that may help optimize it. Since the existence of different versions of the same reports can be confusing to investors and analysts, the FRC advises companies to be as consistent as possible and label different versions as clearly as they can on their websites.

3. Design and Usability

They say first impressions are the last impressions and well-formatted reports certainly make a great first impression on primary users like investors and analysts. In its sample of 50 tagged reports, the Lab made several observations with regard to the look and feel of structured digital reports and their utility to various stakeholders by making assessments across five key areas of interest.

- Visual Design – In its implementation study from last year, the FRC found several issues in the human-readable layer of the report that included fonts and images being displayed incorrectly. While these issues seem largely resolved this time around, the FRC advises companies making use of PDF to XHTML conversion software to make their design agencies aware of particular fonts, colors, and other specifics to utilize in order to avoid conflicts during conversion. More complex formatting issues can occur in the front half of company reports that are design-heavy and subsequently, the FRC suggests companies include them in dry runs to avoid issues in the final XHTML.

- Company Website Availability – The FRC Lab’s study found that 32 out of 50 companies filing a tagged report to the NSM made the XBRL report package available on their corporate website. Of these, 21 companies made it available with an iXBRL viewer allowing them to be interacted with, by investors and analysts. However, some uploaded packages had an incorrect folder structure that would otherwise not pass with the FCA. The Lab, therefore, recommends companies put up the same version of the report that has passed validations with the FCA.

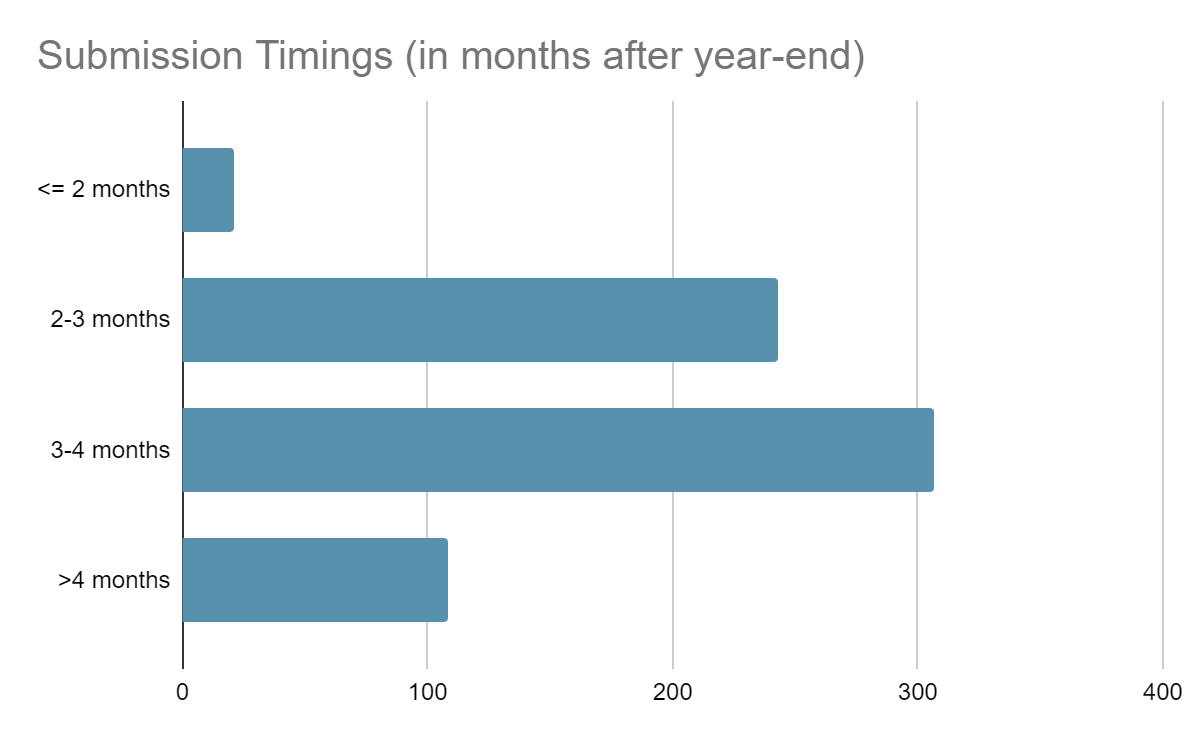

- Submission Timings – While > 99% of the filed reports were submitted within the six-month period allowed by the FCA owing to COVID-19, companies need to be aware of a reversal to a four-month period for year-ends on or after 28 June 2022. Considering tighter timelines and broader tagging requirements in the form of text block tagging, companies would do well to reconsider the viability of their timetable for next year’s reports. Reducing the time lag between the announcement of results and report publication is one of several ways to add value for all stakeholders. Many large companies with complex operations have managed to achieve this early in the digital reporting season, indicating a favorable trend in corporate reporting. However, many companies continue to produce reports in PDF, which does nothing to satisfy obligations under DTR. As reporting tools and processes continue to evolve, more companies using IFRS standards are expected to transition exclusively to digital reporting in iXBRL.

Source: FRC Study

Source: FRC Study

- Loading Time and File Sizes – Some of the structured reports uploaded by companies were slow to open once downloaded. Primary causes include long render times owing to many images, unnecessary tags, embedded resources, and more, along with inefficient code in the XHTML. The average tagged report size was found to be 21MB with some reports below 6MB and a few over 70MB. The FRC advises companies to test tagged reports using different browsers and iXBRL viewers and work alongside tagging service providers to optimize loading times.

- Harnessing the Power of XHTML – As PDFs are typically in the A4 format, a lot of companies using the bolt-on approach discussed above end up with structured digital reports that adopt the same dimensions. Since XHTML is a web-based format rather than a print-based one, the FRC advises companies to rethink the way they lay out their reports. This includes:

- Utilizing dynamic charts/graphs and improved navigation to jump between different parts of the report with ease. This will make the report a lot more interactive.

- Structured reports should be better optimized for search engines (SEO) so that they are more easily discoverable by a larger audience.

- Companies uploading their reports to their corporate website should also strive to achieve better integration with the rest of the website and focus on web analytics to assess the traffic.

- Companies should focus on accessibility and responsiveness to enable seamless viewing on different screen sizes at different zoom levels.

FRC Lab’s ESEF Reporting Study – The Future and Beyond

The FRC Lab’s study not only highlights various areas of improvement for filers but also gives us a peek into what is to come in the future with regard to structured digital reporting. While it concedes that companies may be unable to change their practices in the short term (the Companies Act still requires companies to be able to produce a printed copy of their report if requested), it aims to nudge companies into transitioning to the new format by being proactive and adopting certain best practices as early as possible with the view to saving them a lot of time and resources in the future.

While tagging has been limited to the primary financial statements and a few mandatory tags in notes, companies will be required to tag notes as well as accounting policies for financial years starting on or after 1 Jan 2022. This enables improved navigation in reports along with automated text analyses of notes. Companies will need to test text block tagging well before their year-end and spend time mapping mandatory tags to their notes. Since this will involve judgment, it is crucial to work closely with a reliable partner to utilize tools that will apply text block tagging correctly.

There are four factors companies need to consider going forward.

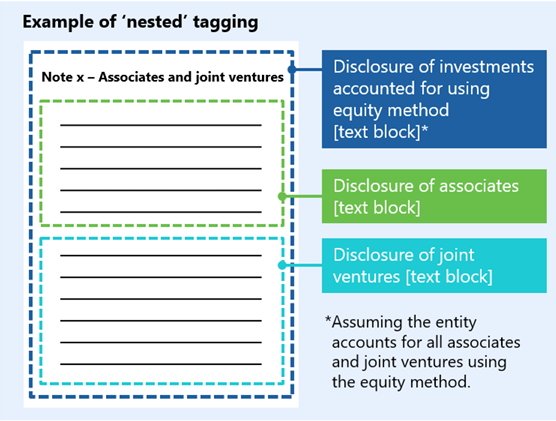

- ESMA’s recent clarification requires companies to apply tags from a mandatory list if the corresponding disclosure is present in a report. This entails nested tagging or tagging a single piece of information with more than one text block tag. Companies need to test how this works in their existing tool or consider moving to one that supports it.

Source: FRC Study

Source: FRC Study

- Companies need to ensure that the information contained within a particular tag is accurate and complete. iXBRL continuation or exclusion mechanisms should be used to merge relevant sections if one text block tag corresponds to multiple pieces of information spread across the report.

- For companies using a bolt-on approach, words in the machine-readable layer of the report should appear in the same order as in the human-readable counterpart, ensuring that spaces between words are not lost. This may create conflict when converting from PDF to XHTML using OCR.

- Companies need to agree on the approach to note tagging with assurance providers in advance, should their report be subject to external assurance.

With sustainability disclosure requirements spawning new standards for structured reporting, tagging requirements are set to expand in the future. It is important for companies to stay on top of things and get the ball rolling on structured reporting as soon as possible. A trusted and reliable partner goes a long way in ensuring reports are not only compliant and free of errors but also add extra value to concerned stakeholders due to their high quality.